Explain how certain factors salary state of residence cost of living can affect the amount of taxes owed and how much you have leftover to spend. Read the following statements and determine which type of tax the statement describes by putting the corresponding letter in the blank.

Inspiringclassified Create A Worksheet

The tax on airline tickets and gasoline.

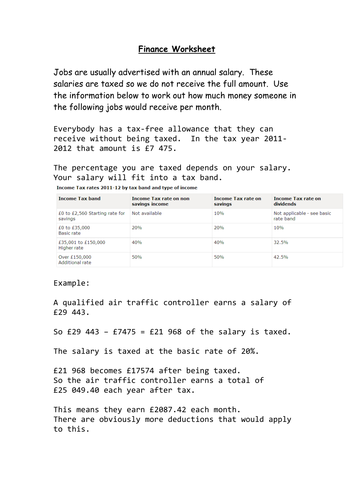

The basics of taxes worksheet answers. The income the nation collects from taxes. Try it risk-free for 30 days. 2- The specific amount paid for this tax increases as income increases.

Funds the Social Security and Medicare programs 2. Includes a teaching lesson plan lesson and worksheet. Ad The most comprehensive library of free printable worksheets digital games for kids.

The tax code directs the collection of taxes the enforcement of the tax rules and the issuance of tax refunds rebates and credits. Answers might include sales taxes like on things they buy income taxes property taxes and Social Security and Medicare taxes. A tax on the sale or use of specific products or transactions.

Students learn about sales tax and discounts. The Basics of Taxes Note Taking Guide 222L1. This tax is determined by a set percentage of earned income 6.

To the Norton School of Family and Consumer Sciences Take Charge America Institute at the University of Arizona Payroll Tax Payroll tax A tax on earned income that supports the Social Security and Medicare programs also known as FICA A set percentage of. Since everyone must pay taxes of some sort -- whether its sales tax on a gallon of milk or capital gains tax on a 5 million stock sale -- its important to get a general understanding of taxation. Funds the Social Security and Medicare programs A.

Waylon contributes about 8 of her earnings to payroll taxes. Sales Tax Introduction Level 1 Worksheet for teaching the concept of a sales tax. If she earns.

The fee to license a car is this type of tax 3. The Basics of Taxes PowerPoint presentation 222G1 may be used to guide the discussion. 1- A tax on earned and unearned inccome.

Quiz Worksheet - Fundamentals of US. A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. Department of Treasury charged with carrying out these functions.

How a Credit Card Works 27. Credit Basics 3 Financial Literacy. A tax that is added to the original price of an item purchased in retail stores.

L 4 The Basics of Taxes E S O N 2. What sales tax will he pay on a DVD player that sells for 129. In his hometown Alejandro pays 4 for state sales tax and 2 for local sales tax.

Payroll tax is paid on only earned. This again is another level of security for the merchant to use when the card is being used in person. The Internal Revenue Service IRS is the government agency within the US.

Instruct participants to use the The Basics of Taxes Information Sheet 222F1 to complete each section of the foldable. Available in English Spanish. The tax on airline tickets and gasoline 5.

In this activity students will be able to. Determine the taxes due for a variety of different people. You will receive your score and answers at the.

Write the three levels of government on the board. 400 per week how much payroll tax does she pay per year. Maxs property tax recently increased by 5.

A tax on earned and unearned income 4. Note that every level of government collects taxes from its citizens and with the classs help categorize the. Discount and Sales Tax Lesson Plan.

The fee to license a car is this type of tax. The Basics of Taxes Name Steven Nixon Directions. Choose an answer and hit next.

After they complete the Worksheet review the answers. Sales Tax Introduction Level 2 INCOME TAX. A tax that takes a larger percentage of income from high-income groups than from low-income groups.

As a class discuss each section of the foldable filling in any gaps in content and answering any questions. 222G1 Take Charge Today August 2013 The Basics of Taxes Slide 12 Funded by a grant from Take Charge America Inc. Get thousands of teacher-crafted activities that sync up with the school year.

Income tax is paid on both earned and unearned income. Lesson includes changing percents and calculating total cost. A tax that takes a larger percentage of income from low-income groups than from high-income groups.

1 point each a. The answer is based in the principle You are better off being in a community than by yourself Taxes are a way that members of a community provide. Get thousands of teacher-crafted activities that sync up with the school year.

This feature allows you to sign the card so your signature can be compared to the one on the receipt you are signing. The Worksheet about tax rates and the difference between marginal tax brackets and the average tax burden. Ad The most comprehensive library of free printable worksheets digital games for kids.

Lesson Closes Review with students the importance of taxes what they fund and why it is important to pay them.

Freebie How To Calculate Tax Tip And Sales Discount Cheat Sheet Sped Math Worksheet Template Printable Worksheets

Combat Pay And The Earned Income Credit A Tax Guide A 1040 Com A File Your Taxes Online Tax Guide Filing Taxes Tax Help

Knowing Basics Of Small Business Taxes Will Protect You And Your Business Small Business Tax Business Tax Money Management Advice

Https Takechargetoday Arizona Edu System Files The Basics Of Taxes Lesson Plan And Info Sheet 2 2 2 0 Pdf

The Basics Of Taxes Page 19 2 2 2 A2 Thebasicsoftaxes Totalpointsearned Name 25 Totalpointspossible Date Percentage Henry Chacon Class Personal Course Hero

Fast Answers About 1099 Forms For Independent Workers 1099 Tax Form Fillable Forms Irs Forms

The Basic Of Taxes Pdf Page 19 2 2 2 A2 Thebasicsoftaxes Totalpointsearned Name Sikoya Smith 25 Totalpointspossible P Percentage Date Class Period 2 Course Hero

Copy Of Basics Of Taxes Worksheet The Basics Of Taxes Name Steven Nixon Directions Read The Following Statements And Determine Which Type Of Tax The Course Hero

Adjectives Worksheet Answer Key Middle School High School In 2021 Adjective Worksheet Adjectives Proper Adjectives

Copy Of Basics Of Taxes Worksheet The Basics Of Taxes Name Steven Nixon Directions Read The Following Statements And Determine Which Type Of Tax The Course Hero

Wages And Taxes Worksheet Teaching Resources

Sole Proprietor Vs S Corporation In 2019 Sole Proprietor S Corporation Corporate

This Product Is A Coloring Activity That Allows The Student To Practice Multiple Step Percent Problems The Consumer Math Seventh Grade Math Middle School Math

References On Resume Best References For Resumes Comprandofacil Co 783 Tax Preparer Resume

Sales Discounts Tax And Tip Homework Common Core Common Core Math Standards Money Math Worksheets Math Word Problems

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Income Tax Return Paying Taxes Income

Copy Of Basics Of Taxes Worksheet The Basics Of Taxes Name Steven Nixon Directions Read The Following Statements And Determine Which Type Of Tax The Course Hero

0 comments:

Post a Comment